With the FRM exam on the horizon, our lead author Christian Cooper has created some Tough Topics videos for FRM Part I and FRM Part II – you can view them here. Below is an introduction to one of the areas of focus, Quant Reasoning.

A lot of candidates on the FRM exam are intimidated by the quant sections on the FRM exams and rightfully so. I think the part 2 quant significantly exceeds anything on the CFA exams but there is a particular use of quant questions I have noticed by GARP that can make a quant question apply across a number of different subject areas.

The use of “quant reasoning” questions are particularly tough and it is one of the reasons I de-emphasize formula memorization and emphasize taking a minute to look at what the formula says.

The trick here is to mentally make changes to the values in the formula to understand exactly how they change in relation to each other. This is especially true of formulas that have a divisor in them.

Let’s start with a simple case from Part II of the FRM.

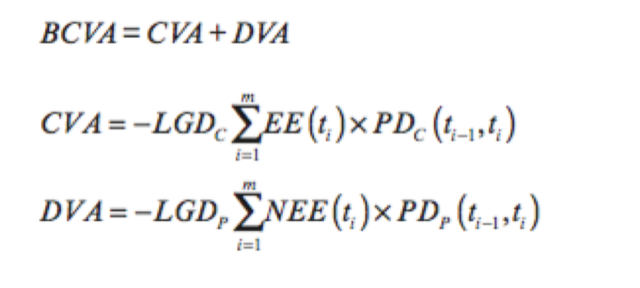

The learning objective says to calculate BCVA (Bi-lateral CVA) and I include this in the study notes:

What I try to teach in quantitative reasoning is this: first notice what is different, in this case the term NEE. Your immediate question should be “What is that?”. I feel like candidates can be so intimidated by the math, it is psychologically easier just to memorize a formula without exploring the underlying mechanics.

Instead of being frustrated if there is something you can’t remember, I am going to use our natural curiosity to help us understand the relationship and develop an intuition around that is WAY beyond memorizing a formula.

NEE here is the “negative expected exposure” which means what if I owe money to someone else (negative exposure) and default. Explicitly, NEE helps us understand the risks we pose to the system.

Now NEE rolls into DVA which is our debt value adjustment as I explain in the books. Now in the questions I wrote for this topic, and across the entire curriculum, I am going to qualitatively test how these values and exposures could change given a change in any of these values.

For example, GARP may set up some long and complicated problem where you have a bank and the swap department is paying fixed on rates, has a risk neutral FX book, and you are asked to calculate the impact on BCVA in a rising rate environment.

Now this question may seem maddening because it feels like you don’t have enough info to answer the question. I haven’t told you the rates on the swaps, I haven’t told you the term, you don’t know if the yield curve is flattening or steepening, you don’t know the current CVA, all of that has been completely left out of the problem but you are still asked to calculate BCVA.

Here is where quantitative reasoning comes in: If I am taking zero risk in FX and am only paying fixed on rates, then it is universally true that the present value of my pay fixed swaps is going to increase. Notice this won’t change any of the probabilities of default (which we weren’t given anyway so we assume those remain the same) but it will change how much I owe to my counterparties. If I owe them money already, my NEE will be less negative and If I don’t owe any money at all, my NEE will be more positive. In any event, NEE only goes one way: higher.

We aren’t done quite yet because the DVA is a negative loss given default (-LGD) multiplied by our NEE (and the unchanged probability of default) because remember, this is the money we owe someone else.

We have already established the NEE only goes one way in this case – less negative or more positive- and a bigger number multiplied by a negative (-LGD) is a bigger negative number meaning our DVA has gone down.

Lastly if the CVA remains the same and DVA is less negative then the BCVA must be less. Less risk on the books, less counterparty risk, etc.

Now, how can GARP ask about this in the answer choices? They could add extra details like wrong way risk, include a scenario that covers central clearing, have a different rate or swap scenario, and in all cases this becomes infinitely easier to really dive into what each part means and how GARP can ask it on exam day.

That is exactly what I do across parts I and II and why I think our FRM offering is unique in the world. I specifically focus on unique ways of looking at quant problems through the lens of quantitative reasoning to help you get through the toughest parts of the exam.

Watch Christian Cooper’s Tough Topics for FRM Part I and Part II here.