At Wiley, we’re always looking for ways to improve and give you more of what you need to pass the CPA Exam (and the CMA and CFA® exams).

Today, we’re introducing a range of updated lessons to prepare you for new questions the AICPA is adding to the 2015 CPA Exam.

CPA Exam Changes: What You Need to Know

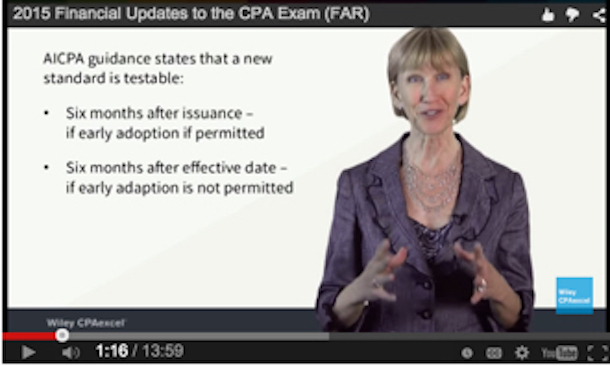

The AICPA is implementing a range of CPA Exam changes to the FAR, AUD and REG sections. Students need to be prepared for a number of new questions.

We’ve asked some of our professors to provide a quick overview of these CPA Exam changes. You can view three free professor videos for an overview of all the changes.

Wiley CPAexcel Course Updates

We’ve updated many of Wiley CPAexcel online lessons to match the CPA Exam changes.

The FAR updates are related to new FASB accounting standards and cover:

- Fair Value Measurement, specifically net asset value measurements

- Cloud-computing fees and expenses

- Bond issue costs

- PCC intangibles in a business combination

- The elimination of extraordinary items

The AUD lessons has also been updated with specific emphasis on recent PCOB auditing standards and the AICPA’s clarified standards for accounting review services. Our REG online lessons have been updated to cover the latest tax law changes for individuals and businesses, notably the Affordable Care Act.

For an overview of all the July 2015 CPA Exam changes, view the videos here.